Assessing investment options for irrigation dams

9 July 2008Michailidis Anastasios and Mattas Konstadinos present a valuation study of irrigation dam investment opportunities in Greece. Using traditional and newly developed techniques, they compare investment by taking an empirical approach and show how this can be adopted to model uncertainty and managerial flexibility in irrigation dam management

The majority of studies on investment decisions have demonstrated that traditional discounted cash flow (DCF) techniques such as the net present value (NPV), benefit/cost ratio (B/C), and internal rate of return (IRR) are the main tools for assessing economic performance. However, some academic researchers introduced the cost and benefit of investment evaluation under uncertain environments, and the decision policy is less aggressive or postponed in comparison with those resulting from traditional DCF techniques [1, 2]. The inconsistency of the above results means it is necessary to gain a better understanding of the evaluation procedure and a more efficient description of the differences between traditional DCF techniques and modern approaches.

DCF techniques versus real options

As a background for discussing the application of the real options approach, it is important to highlight the differences and similarities between the real options investment approach and the conventional decision-making NPV analysis. Dixit and Pindyck [3] note that being able to delay an irreversible investment undermines the simple NPV rule and hence the theoretical foundation of standard neoclassical investment models. The distinction between the real options approach and conventional decision-making is based on the fact that the standard NPV rule does not take into account how the ability to delay irreversible investment expenditure can affect the decision to invest. Regarding investment deferral, NPV does not recognise the managerial alternative of waiting or delaying the start of a project, or phasing a project. However, real options recognise that the decision can be deferred [4]. Delaying expenditure involves the issue of managerial contingency to alter the course in the future. This managerial flexibility is important in structuring the project analysis, as it is often a source of additional value in the decision [5].

To implement NPV, we need estimates of expected future cash flows and an appropriate discount rate. However, an NPV calculation only uses information that is known at the time of the appraisal, meaning we make the calculation using only what is known before the investment begins. The choice is therefore all-or-nothing – not an initial choice followed by more choices as information becomes available. On the other hand the Real Options are not just about ‘getting a number’, they also provide a useful framework for strategic decision making.

So what is a real option? It is the right – but not the obligation – to acquire the gross present value of expected cash flows by making an irreversible investment on or before the date the opportunity ceases to be available [6]. Although this sounds similar to NPV, real options only have value when investment involves an irreversible cost in an uncertain environment. And the beneficial asymmetry between the right and the obligation to invest under these conditions is what generates the option’s value. By using the conceptual real option framework of Dixit and Pindyck [3] one can estimate the value of investment opportunities of irrigation dams and the optimal trigger price for initiating an investment based on irrigation water prices.

Conclusively, valuing irreversible investment opportunities under uncertainty using NPV does not take account of managerial options and treats capital assets as being passively held. A real options approach can help by valuing these managerial intangibles and preventing mistakes. But don’t let this obscure the simple intuition. Where appropriate, real options will help you make better decisions.

However, it is important to realise that the application of real options theory will not deem traditional NPV obsolete, or replace it entirely. To the contrary, real options valuation should ideally be applied as an additional analysis alongside current capital budgeting systems, not as a surrogate for them [5]. Real options analysis increases the overall understanding of the investment decision, and aids decision-makers in recognising uncertain areas that NPV does not.

Is the investment for irrigation dams different to other types of dams?

Financial analysis of irrigation dams is a very complex task mainly due to the required long planning horizon and immense demand of public funds. In addition the field of dam infrastructure entails many uncertainties making strategic managerial decision-making crucial. Thus, the evaluation of any dam investment has to be accompanied by an investigation of the effect of uncertainty and risk.

The general evaluation framework between irrigation dams and other types of dams is very similar. Especially when using traditional DCF techniques there is no need for any specialised adaptation of the evaluation model. On the other hand there are three main differences when using Real Options: (a) the choice, (b) the values and (c) the modelled distribution of the uncertainty factors. For example, the water price of a single unit probably varies between an irrigation dam and other types of dams or the modelling of the available data may follow different kinds of distribution. However, the outline of the evaluation procedure of irrigation dams is very close to other types of dams.

Greek case study

This section presents an ex ante comparative application of both DCF techniques and the real options model in a case study in Greece. An irrigation dam named Petrenia is planned to be constructed in a Greek rural area (central Chalkidiki) to irrigate around 1000ha of agricultural land (olive trees, vegetables, grape vines). Although the investment will be financed by the Greek Ministry of Agriculture and the European Union, it is expected that a large part of the total construction cost will be recovered from beneficiaries collected from the water users.

According to the definition of the international-commission-on-large-dams (icold) [16] the Petrenia dam is classified as a large dam. The main geometrical elements of the dam are: (a) coronation length L=125m, (b) height H=36m and (c) useful capacity V=260,000m3. The outfall basin area is calculated to 41,450km2 with a 38km perimeter. The minimum, mean and maximum elevation of the basin is estimated to 296.75m, 670m and 29m respectively with a slope of 27.75%. In addition, the total amount of water storage is equal to 3,900,000m3 per annum and the project is expected to irrigate more than 700ha of olive trees and 300ha of other crops.

The economic analysis of the project is obtained from data provided by the statistical service of the Greek Ministry of Agriculture and several past studies [17, 18]. In tabloid form, the Petrenia irrigation project is expected to require a total outlay of €7,947,761.55 (during the construction phase) including €3,815,113.72 for the irrigation canals and the underground components of the project. The project is required to provide 10% of annual pre-tax revenue for payback during the operating stage. The annual operation cost (€120,815.85) includes salaries, materials, any conservation expenses and payments for several other services. The operation of the Petrenia dam will cover more than 90% of the region’s total irrigation needs until the year 2020. Estimates of total direct annual revenues are equal to u890,388.85 including all water uses.

The first stage of the investment analysis includes the application of traditional and static DCF technique. The derived NPV (€1,135,849.88) suggests that the Petrenia irrigation project is an economically feasible investment. Moreover, the sensitivity analysis (after ±20% fluctuation of each factor ceteris paribus) of the NPV shows that the dam is, in any case, an acceptable investment. However, results from the second stage of the investment analysis (real options approach) suggest the same investment as a non feasible one. In particular, the real option approach was applied following the empirical model presented in Table 1. The mean and the variance of net annual returns of the Petrenia dam were determined by 25,000 Monte Carlo iterations using the @RISK software (Palisade). The available hydrologic resources and the water price were selected as two of the most important uncertainty sources, of the dam [18]. The dam’s water capacity has been modelled as a gamma distribution, using the @BEST FIT software (Palisade), while the selling price of the single water unit (m3) has been modelled as a triangular distribution. The expected mean water capacity (water production minus evapotranspiration) is 6,022,286m3/yr with a standard deviation equal to 4,353,497m3/yr. The most likely price, administered by the central municipality corporation, is €0.36 per m3, with an expected price range between €0.32 and €0.40 per m3 due to rainfall disparities from year to year. The expected mean of the net annual returns [E(R)] is equal to €222,657.20 with a standard deviation of €1,114,225.00.

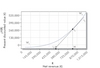

Table 2 presents the main parameters for the value of investment and wait opportunities. One hundred iterations (simulations) were used to derive the parameters µ? and s?. The initial investment cost is equal to u4,400,000 and the investment cost of irrigation canals amounts to u3,815,000. The annuity (a transformation of the discounted values in an annual basis) has been computed assuming a long-run loan of fifty years and 6.5% rate of interest. So, the Marshallian trigger (M) of the initial cost is equal to €540,236.52. Therefore, the investment’s net annual returns (b/b-1) must be at least 1.5087 times greater than the corresponding Marshallian trigger; that is higher than €815,070.41 (Figure 1).

Thus, results from the real options approach could not justify that the Petrenia irrigation dam is an economically efficient investment, though that the results of NPV signal the opposite. In particular although the simulated annual returns [E(R)] have to be larger than €815,070.41, according to the optimal investment trigger (H), the expected mean of the net annual returns [E(R)] is equal to €222,657.20. This suggests that although the application of both the real options approach and NPV could lead to a different outcome, they offer additional insights in investment decisions. In this particular investment, the decision makers might consider delaying the investment and keeping options open for the future.

The value of waiting and the optimum investment trigger (H) can be illustrated using the diagram (Figure 1) described by Dixit [9]. The corresponding V(R) function is drawn thicker, with convex curve W1i2 of the curve of waiting to the left of H, and the straight line i2i3 of the net worth of the project to the right of that point. The Marshallian trigger M is where the value of investing just becomes positive, that is, where the straight line i1i3 crosses the horizontal axis. The optimum trigger H is obviously to the right of this. The curve BRß (value of waiting: i2W2) lies above the line R/?-K (value of investing: i2i3) to the right of H and waiting again the preferred policy for higher values of R.

Conclusion

This paper demonstrates that although the traditional NPV model accepted the dam investment in the example of the Greek dam, the option analysis provided more realistic results. An important outcome from this paper is that the options inherent in a dam project add value to the project. Coming up with an approximate value for these options may be sufficient to properly assess a project, and, in any event, is better than a static net present value analysis. Large investments financed by public funds – like irrigation dams – must be very carefully designed and studied before the project is approved. Therefore, combining the DCF techniques with new advanced methodologies could significantly diminish the weakness of the DCF techniques.

Michailidis Anastasios and Mattas Konstadinos Aristotle, University of Thessaloniki, Greece. Email: tassosm@auth.gr, mattas@auth.gr