Central Africa possesses huge untapped hydroelectric potential that could be developed for the benefit of the region and the wider continent. The required investment has been less than forthcoming, partly because of intense conflict in the Congo Basin and elsewhere, but also because local power utilities lack the financial muscle to fund dam construction. International firms have been unwilling to invest in power generation of any kind in most parts of Africa. However, a new kind of power sector company has now agreed to develop a hydro scheme in Cameroon that could encourage further investment across the region.

The 200MW?Memve’ele hydro project in the southern provincial district of Ma’an of Cameroon, close to the border of Equatorial Guinea, is to be developed by the UK’s CDC Group (formerly known as the Commonwealth Development Corporation). When the project was originally agreed with the Government of Cameroon, it was signed by CDC offshoot Globeleq, but responsibility for managing Memve’ele is now in the process of being transferred from Globeleq to Actis Infrastructural Fund. Actis, which will manage the venture on behalf of CDC, is a private equity company that specialises in emerging markets. CDC aims to invest in infrastructural projects in developing countries that are commercially attractive but which also boost the living standards of people living in some of the world’s poorest countries. CDC had previously concentrated on investing in thermal power plants in Africa, Asia and Latin America but in August and November last year it signed agreements with the Government of Cameroon to develop the Memve’ele hydro scheme on the Ntem river.

The 200MW of generating capacity will provide a significant boost to a power sector that currently relies on just 902MW of capacity. A new transmission line will be needed to link the national grid to the site. The preliminary technical studies for the project are to be undertaken this year but no further project details are available at present. Details of the dam and turbines to be developed on the river Ntem have not yet been released.

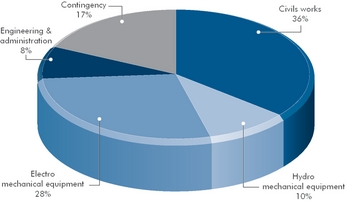

CDC will provide 30% of development costs, the remainder supplied by the African Development Bank (AfDB), the Development Bank of Central African States, the Dutch Development Bank, the Arab Development Bank and the Multilateral Investment Guarantee Agency (MIGA), a member of the World Bank Group. The hydro scheme will be developed under a build, operate, transfer (BOT) contract, after which the asset will be passed to the Government of Cameroon. Providing the preliminary studies proceed as planned, construction is scheduled to begin in 2009, with the first electricity due in 2013.

An operating concession will be awarded once CDC has completed its preliminary commercial and technical studies, and the government has concluded the various environmental and social impact assessments. The government will also be responsible for feasibility studies on access roads and the transmission line. Whether or not a concession is awarded, the framework agreement will expire in two years. CDC has not put a figure on the total cost of the project but a government official suggested in 2005 that it could be CFA Franc 142B (approximately US$330M).

Cameroonian officials said 50MW of Memve’ele’s capacity will be used to supply the Alucam smelter, while a further 20MW will be dedicated to rubber company Hevecam. It has also been suggested that Equatorial Guinea will sign up to another 50MW of capacity, with Gabon a further potential customer. Cameroon’s Minister of Finance, Polycarpe Abah Abah, commented: ‘This project is really important for the economy of our country. You know that we are facing serious energy problems every day. On a daily basis, it affects our industries, our enterprises and household use. That is why I think the signing of this convention is a giant step in resolving this energy crisis that very negatively impacts our economic growth.’

The Cameroon power sector

Unlike in many other African states, an international power company is already heavily involved in the Cameroonian power sector. US company AES Corporation took a majority, 56%, stake in power utility Société Nationale d’Electricité de Cameroon (SONEL) in 2001, leaving the Government of Cameroon with the remaining 44% equity. Through its AES SONEL offshoot, AES currently controls the entire power sector from generation through to transmission and distribution. The rate of electrification is higher than in most other countries in the region and power is now supplied to 500,000 homes.

At present, the main thermal power plant is the 85MW Limbé facility, which relies on expensive oil feedstock and which is generally used as back up generation during the dry season and prolonged droughts. Although Cameroon possesses significant but scattered associated gas reserves on its established oil fields, the government has had little success in attracting foreign investment in gas to power projects. As a result, the country continues to rely on the hydro sector to provide 87% of all power production. The 384MW Song Loulou and 263MW Edea hydroelectric projects, both located on the Sanaga river, are still the largest hydro schemes in Cameroon, as development plans for Lom Pangar, Memve’ele and Nachtigal dams have been repeatedly delayed.

AES SONEL requires access to greater generating capacity, either from its own plants or independent power producers (IPPs), if it is to continue with its rural electrification programme, and supply increased industrial capacity. Much of the company’s budget for 2005-09 is dedicated to improving downstream infrastructure, so it is likely that much of any additional generating capacity will be provided by other investors.

One of the power utility’s main aims is to increase the size of its customer base over the next decade and beyond, partly by extending its regional power grids to parts of the country that were previously unserved.

This expansion programme, including the addition of 50,000 new connections every year for the next 14 years, has now been included in the contract AES SONEL holds with the government and so must be implemented through the commissioning of new generating capacity. In 2006, the firm secured a US$405M loan from the World Bank’s International Finance Corporation (IFC) to fund its transmission and distribution projects, one of the biggest loans ever awarded to a privately owned power company in Africa.

Additional funding has been provided by the European Investment Bank (EIB), AfDB, the Central African Development Bank, Deutsche Investitions und Entwicklungsgesellschaft (DEG), the Emerging Africa Infrastructure Fund, the Netherlands Development Finance Company, and Proparco.

John McLaren, the president of AES Europe, CIS and Africa, said: “This is the most ambitious expansion programme for Cameroon’s electricity sector. We expect to more than double the number of people we serve in Cameroon and to provide electricity to thousands of individuals who never had it before. AES SONEL is committed to improving Cameroon’s energy sector, which is essential to the country’s continued economic development and we’re pleased to move forward with the government under our amended concession agreement.”

Demand for electricity is currently growing by about 8% a year and the government has set a target of more than doubling national capacity to 2,000MW by 2015. The completion of Memve’ele would be a start but the government is eager to ensure that Lom Pangar and Nachtigal are also developed. This goal is achievable but only if all the projects currently in the pipeline are actually developed. While Cameroon has one of the most diverse economies in Central or West Africa, with a significant manufacturing sector, the lack of power generating capacity has indeed held up economic growth for many years.

A new interconnector between Cameroon and Chad has been proposed that would allow Cameroonian hydro schemes to export electricity to its neighbour. Although Chad has traditionally been one of the least developed countries in the world and is currently suffering from severe political instability, its economy is expanding rapidly as a result of its new oil industry and the Chad-Cameroon oil pipeline. As a result, the country is now in a somewhat better position to import electricity than previously.

Aluminium sector demand

However, it is domestic industrial consumption that is likely to provide the main market for any new hydro projects. Aluminium company Alucam already absorbs almost 45% of total electricity production at its Edea smelter but plans to boost output at the plant from 90,000 tonnes per year to 300,000 tonnes per year were held up by the lack of new power generating capacity. Alcan of Canada (now part of Rio Tinto) and the Government of Cameroon had both held 46.7% stakes in Alucam and both had hoped that the Lom Pangar and Nachtigal schemes, which would also be developed on the Sanaga river, could be developed to supply electricity to the smelter.

However, Rio Tinto has adopted a new approach since it took over Alcan in November 2007. Two weeks after the Alcan acquisition has been completed, the new firm of Rio Tinto Alcan announced that it had signed a preliminary development agreement with the Government of Cameroon for the development of a 1,000MW hydro scheme at Songmbengué that will provide both power and water for a new green field aluminium smelter with production capacity of 400,000 tonnes per year.

Technical and pre-feasibility studies for both the smelter and the power plant will now be undertaken, with the final investment decision expected by the end of 2009.

The chief executive and president of Rio Tinto Alcan Primary Metal, Jacynthe Coté, said: ‘What we are seeing today are the results of the long and prosperous collaboration between Rio Tinto Alcan and the Government of Cameroon. This is a promising project that will have a positive impact for all stakeholders.’

However, investigating the Songmbengué scheme does not mean that the Lom Pangar and Nachtigal ventures will be abandoned. All technical studies and the environmental impact assessment on the construction of a 330MW hydro plant at Nachtigal to supply the existing Edea smelter have now been completed. As a result, Rio Tinto Alcan is now negotiating the terms of a power purchase agreement (PPA)?with AES SONEL, which is expected to operate Nachtigal.

In addition, Rio Tinto Alcan and the government have agreed to discuss how to speed up the construction of the Lom Pangar project. Not all of the electricity from the three schemes would be used to supply aluminium smelters; a large proportion could be made available for wider distribution by AES SONEL. US mining company Geovic has also discussed developing cobalt reserves in the south east of the country and it, too, would require substantial electricity supplies.

The environmental impact assessment on the Lom Pangar project, which would be located 4km downstream of the confluence of the Lom and Pangar rivers, is now underway. Figures for the expected generating capacity of the scheme vary but the government predicts that the dam would help to boost generating capacity at the existing Song Loulou and Edea hydro projects by between 105MW and 216MW during droughts.

However, the World Bank is concerned that the new dam could have an impact on the Chad-Cameroon oil pipeline, as the reservoir will submerge part of the pipeline. There are also fears about the impact on local farm land and on the Deng Deng Forest Reserve, which is home to an important gorilla population. There is also extensive tropical hardwood forest that would be flooded.

CDC strategy

Yet, while Cameroon’s potential as an aluminium producer has long been recognised, it has taken a company with development priorities to finally put pen to paper on the first new hydro scheme. The British firm’s strategy could herald similar ventures elsewhere in the developing world. CDC has recently sold generating assets in North Africa, Asia and Latin America, and so appears to be focusing solely on Sub-Saharan Africa. A company spokesperson said that after last year’s sales, it still had a diverse portfolio of developments, with 1,500MW of generating capacity including the 200MW Memve’ele project. Divesting itself of power plants after just a few years of operation could be part of the company’s strategy, as it seeks to ensure the success of each project before handing over the reins.

CDC’s other generation projects in Africa are the Azito Energie 288MW gas fired plant in Cote d’Ivoire; the Sidi Krir 685MW gas fired facility in Egypt; the Tsavo Power 74MW fuel oil thermal plant in Kenya; the 180MW gas fired plant in Tanzania; and South Africa’s 600MW Kelvin coal-fired facility; so it is interesting that Memve’ele is its first hydro scheme. When asked whether his company had a new found interest in hydro, the CDC spokesperson said that the company ‘has always evaluated each project based on its characteristics and the characteristics of the market it will serve; our work on Memve’ele reflects that. When considering the development of a new power plant, we evaluate all of the practical alternatives and are guided by what makes the most sense, in terms of technology, size and commercial terms, for the market we wish to serve’.

However, it is difficult to escape concluding that some large hydro projects, particularly in developing countries, are becoming more acceptable. Historically, the advantages in terms of development have often been outweighed by the environmental damage, but the additional benefits of low carbon power generation could now make hydro more attractive to the multilaterals and a number of potential investors.

While the World Bank had tightened the criteria for supporting large hydro in the wake of the World Commission on Dams (WCD) report, it now seems more enthusiastic about hydroelectric ventures that promote development and help to tackle climate change. In April last year, it completed its programme of economic, environmental, and social due diligence on the long-delayed Bujagali hydro scheme in Uganda and its subsequent financial backing gave the green light to a procession of banks to do likewise. Construction of the project began last year, and the electromechanical contract was recently awarded. The plant is due to be operational in 2011. The World Bank lending guidelines are followed by many other funding organisations and some privately-owned companies, such as CDC, so the multilaterals slight change of approach seems to be having a far greater impact than might be expected from its own limited investment funds.

CDC chief executive, Richard Laing, says that his company’s existing US$2B in assets will enable it to expand its operations. He commented: ‘We will now use this as a platform to invest more in power generation in Africa. Many countries in Africa have mineral wealth, high economic growth, and the additional attraction of consumers in the region now experiencing, for the first time, a higher amount of disposable income. Africa has caught people’s imagination.’ Laing said that India and China were still generating the best financial returns but added that interest in Africa was increasing, particularly among more mainstream private equity companies. He concluded: ‘Firms like CDC, however, are still needed to fill some of the investment gaps particularly in relation to funding for small and medium sized enterprises.’

Given the reluctance of many other international investors to dip a toe in African waters, CDC’s strategy of focusing on emerging markets power projects that are commercially driven but which also bring significant benefits in terms of development could be a model for more general power sector investment in Sub-Saharan Africa. Coupled with Chinese investment in Ghana’s Bui hydro scheme, new sources of financial support do appear to be emerging but it is certainly interesting that a development-led power company has opted for hydro in the case of Cameroon. Whether the company pursues this policy in other African states remains to be seen, but if CDC believes that Memve’ele can be profitable, there are dozens of similar undeveloped sites across Central Africa that could be exploited by private sector investors.